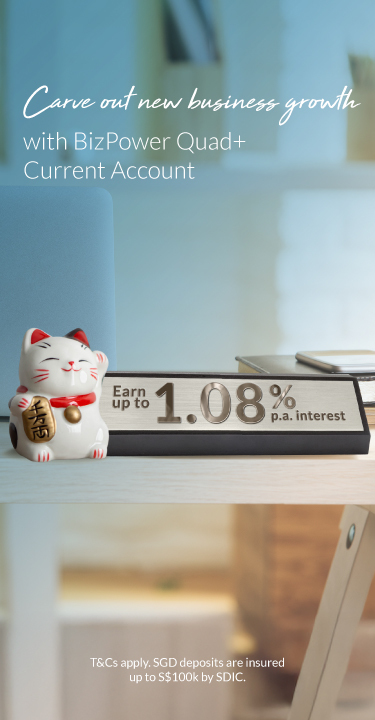

Deposits

Loans

Trade

Treasury